The Austin Technology Council and Chamber of Commerce announced a partnership this week to attract more investment in local tech companies at later stages of growth.

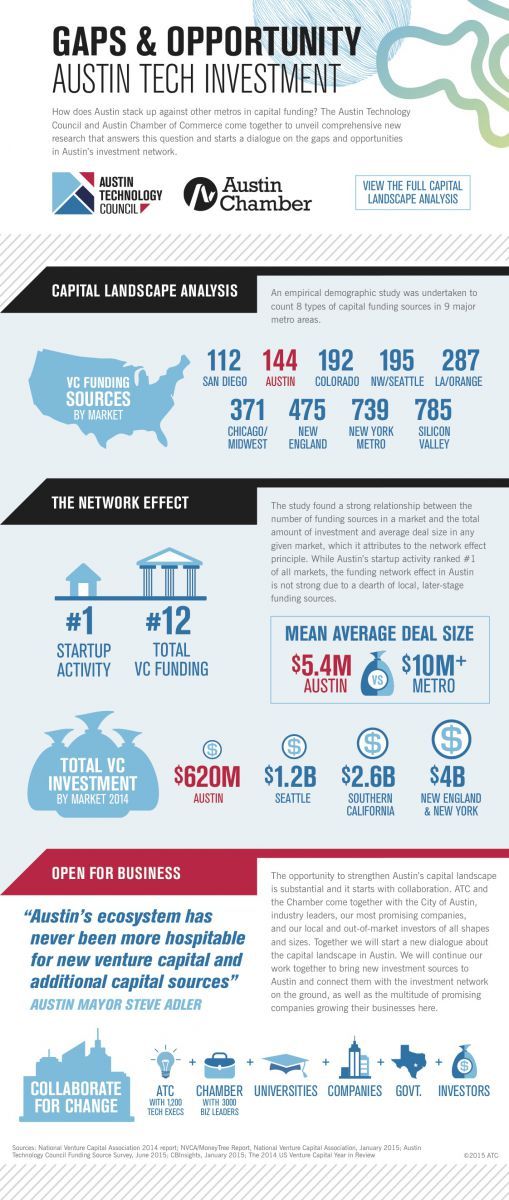

The move is in conjunction with a study released today showing a capital gap in Austin’s venture capital landscape compared with eight other U.S. tech hubs. The analysis combines data from CB Insights and research conducted by the Munday School of Business at St. Edward’s University.

The study’s main finding was that fewer funding sources translates to smaller deals on average. In Austin, that means it’s harder for startups to raise money as they outgrow the earliest stages of fundraising.

But that’s a big opportunity for larger investors to get in early with Austin’s exploding network of growing startups, according to Julie Huls, president and CEO of Austin Technology Council.

The ATC is partnering with the Austin Chamber of Commerce and local officials to court larger investors in mature markets like New York and Silicon Valley. In those markets, equity firms compete to invest early enough in high-growth companies.

Huls (pictured right) said those investors are starting to notice secondary markets like Austin are ripe for the picking.

“If we were strong in every category, or more of them, we know our companies would have access to the fuel it takes to grow to the scale to go public or be acquired,” she said. “We certainly have success stories [from Austin companies that have recently been acquired] and we’re very proud that will allow us to compete at a higher level.”

While Huls and the ATC focus on providing data to quantify the opportunity in Austin, the Chamber of Commerce spreads the message to other markets.

Michele Skelding (pictured left), the Chamber’s senior vice president of global technology and innovation, said the Chamber will expand its active recruitment programs, annual A-List Awards and legislative work to build a robust investment ecosystem in Austin.

“It’s an establishment of curating relationships with investors at the stage where they’re interested in investing,” she said. “We focused on the early-stage, out-of-market investors in the early years. Now this data helps us focus on that next level, which is series B and beyond.”