First Dollar, an Austin fintech startup that makes it easier for people to pay for HSAs, FSAs and other health benefits, announced Tuesday that it partnered with New Jersey-based DriveWealth to offer an HSA investing experience on its Health Wallet platform.

First Dollar currently allows health plans, financial institutions and third-party administrators to provide HSAs, FSAs and other health benefits on their own card or member portal. As a result of First Dollar’s new partnership with DriveWealth, consumers with HSAs will now be able to buy fractional shares of stocks, as well as equities and ETFs, from that same Health Wallet.

The Health Wallet is available in English and Spanish. By introducing HSA investment to the platform, First Dollar said it hopes to unblock access to an in-demand and central benefit of HSA plans.

“We now have the freedom to continuously adapt our product for both our English and Spanish speakers, opening up access to those who have historically been excluded from the investment experience,” Izamar Loredo, senior product manager at First Dollar, said in a statement.

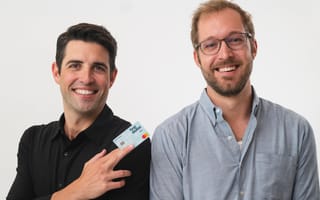

First Dollar was co-founded in 2019 by CEO Jason Bornhorst and CPO Colin Anawaty. The duo previously launched Patient IO, which they sold to AthenaHealth in 2016. First Dollar raised a $14 million Series A financing round in January.